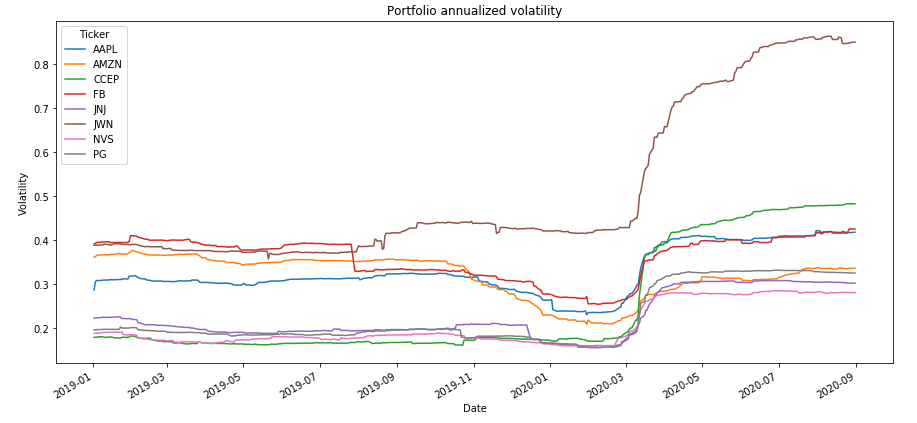

How to Calculate the Daily Returns And Volatility of a Stock with Python | by Khuong Lân Cao Thai | Dev Genius

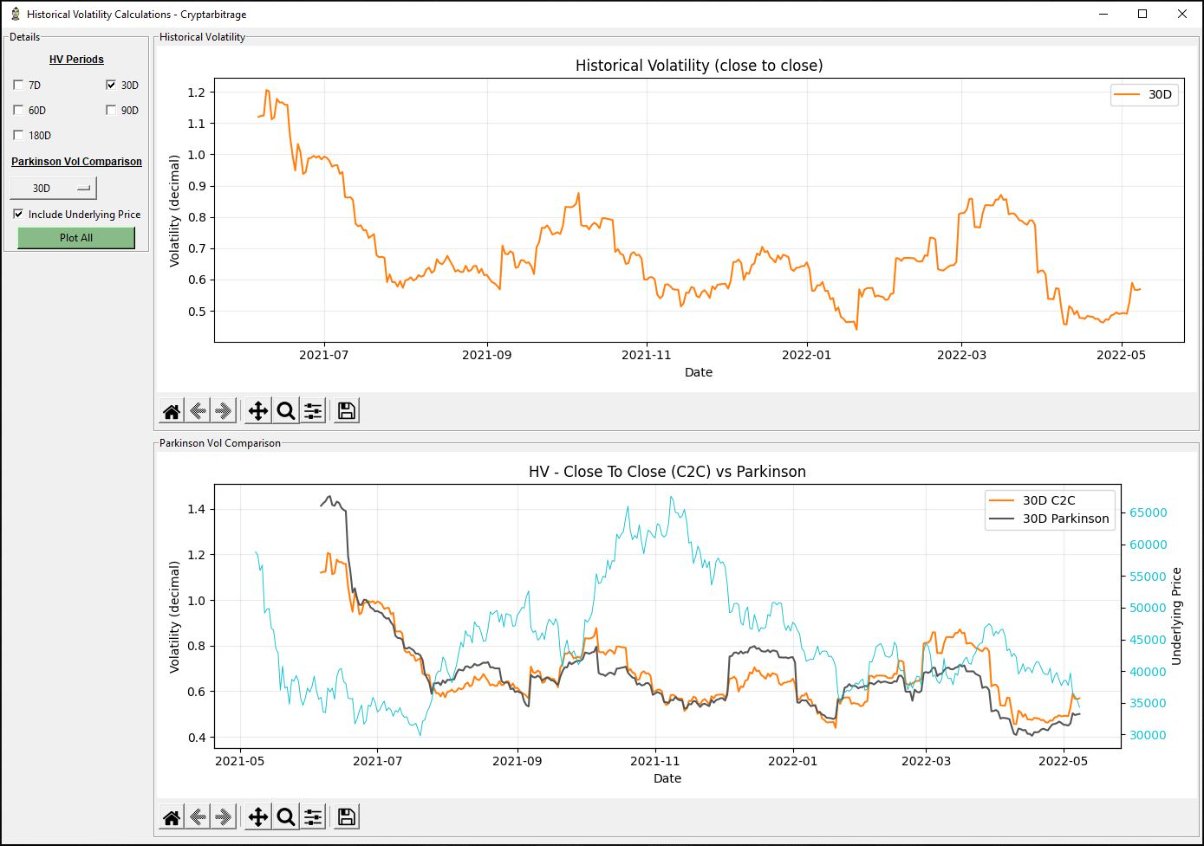

Stream episode Parkinson Historical Volatility Calculation – Volatility Analysis in Python by Harbourfront Technologies podcast | Listen online for free on SoundCloud

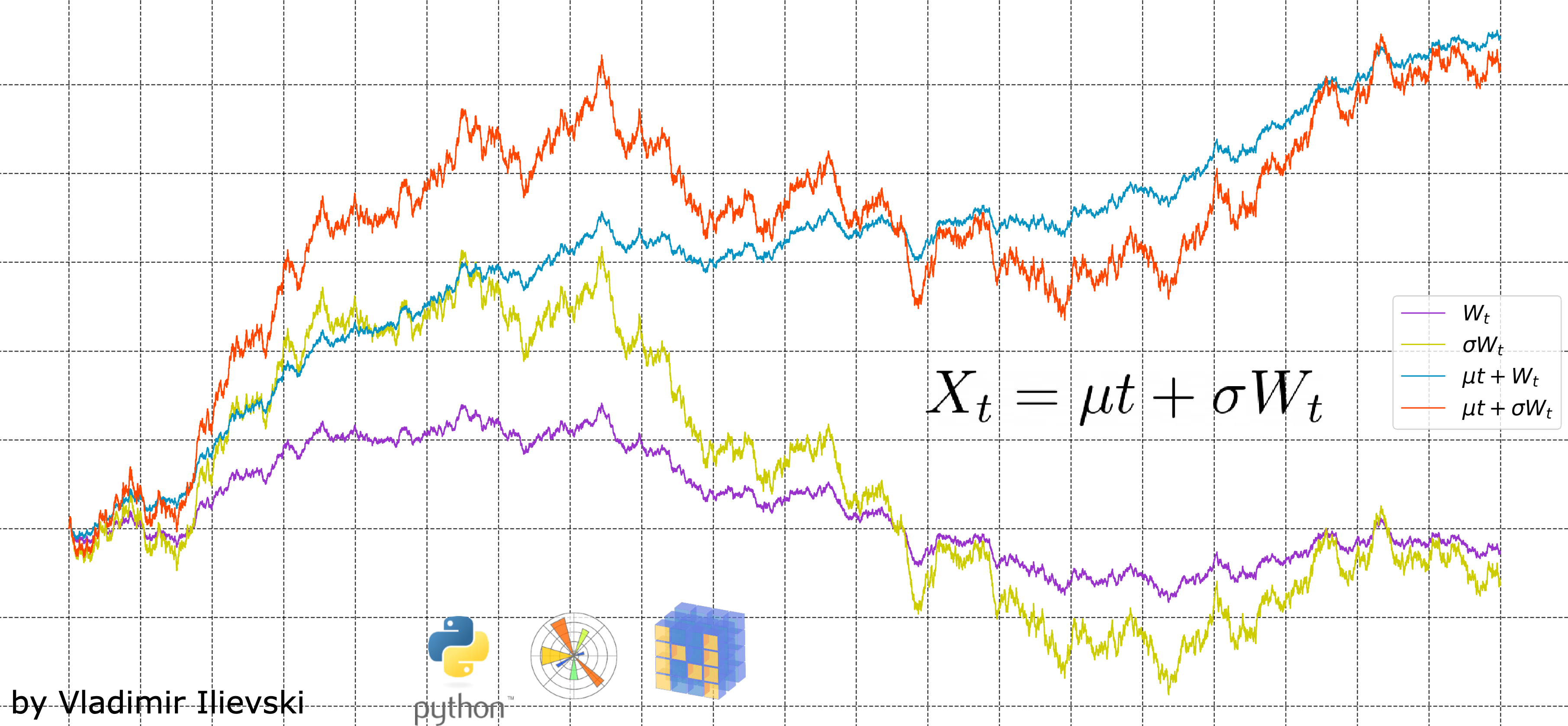

Forecasting Volatility with GARCH Model-Volatility Analysis in Python | by Harbourfront Technologies | Medium

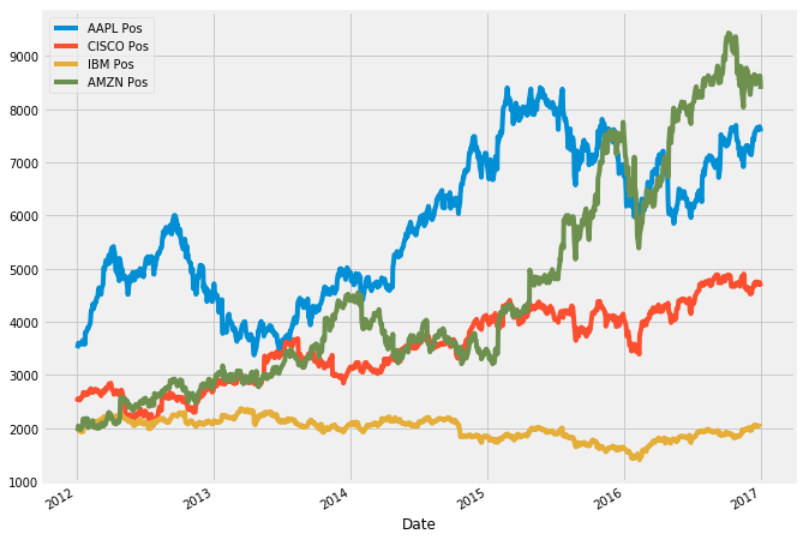

Profit Adda: Calculate Pre-Determined Prices of Various Stocks with the help of Bollinger Bands in Python.