Disputed Income Tax Calculation based on FAQ from CBDT Circular invalid if Specific Provision exists in Act: Bombay HC remands matter

Page 3 - Newsletter (Provision Regarding the Calculation of Taxable Income for Life Insurance Companies)

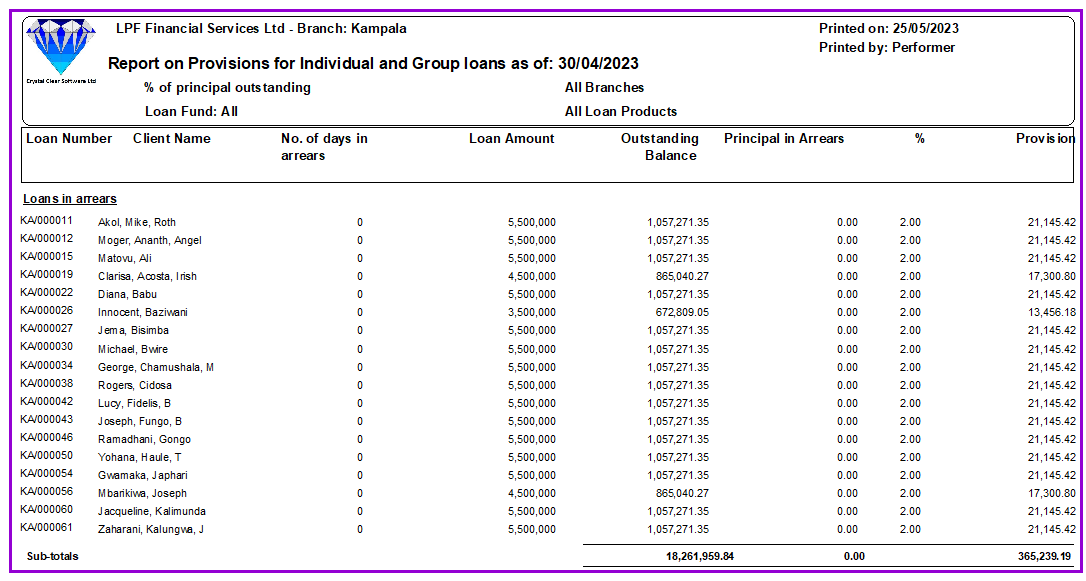

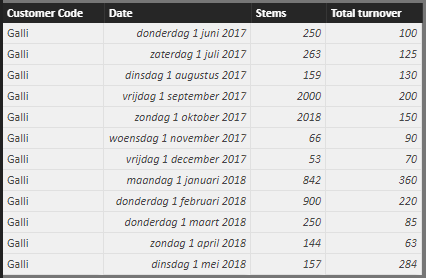

Calculation of provision for doubtful debts as of 31.12.2015 (according... | Download Scientific Diagram

Energies | Free Full-Text | A Survey Data Approach for Determining the Probability Values of Vehicle-to-Grid Service Provision

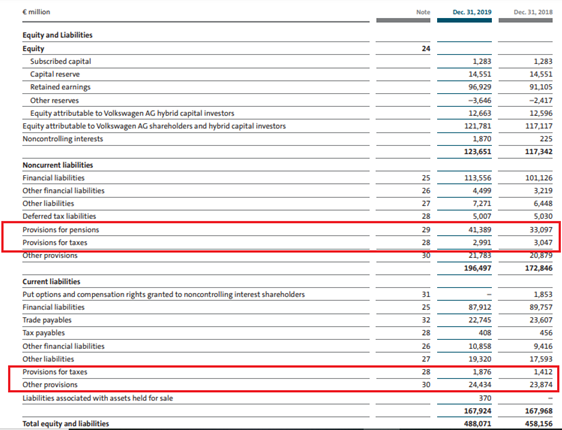

IMPAIRMENT LOSSES ON SHARES The calculation of the provision for tax-deductible impairments, in the case of group entities, join

:max_bytes(150000):strip_icc()/generalprovisions_final-e246d5a375ed4e56993b2e06cd1004cf.png)